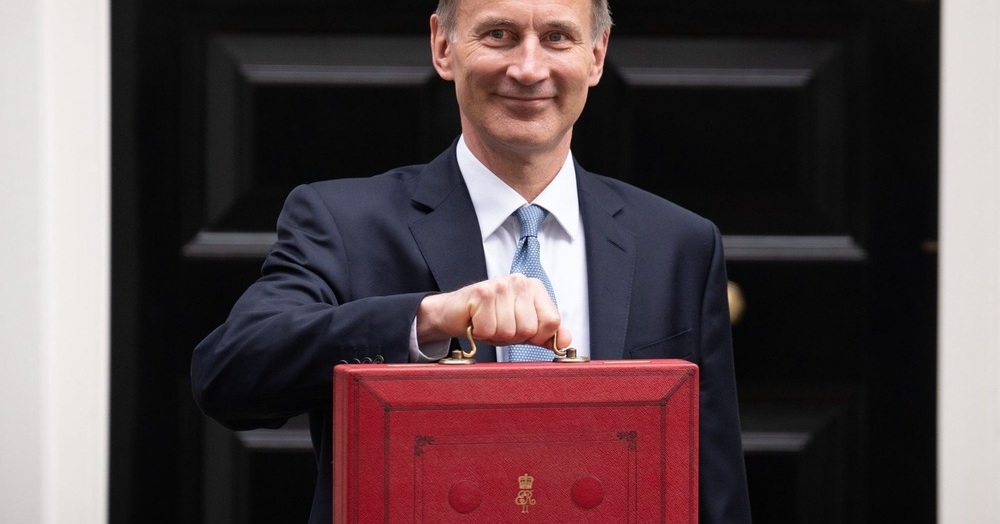

Budget 2024: Chancellor’s statement

The chancellor Jeremy Hunt has just concluded delivering his 2024 Budget.

The Chancellor has confirmed that the OBR's forecast for UK economic growth remains largely unchanged from last November's Autumn Statement. Gross domestic product is expected to be slightly higher this year at 0.8%. However, in 2027, the OBR projects a growth of 1.8%, compared to the previous prediction of 2% in November. By 2028, it is expected to drop to 1.7%.

The UK housing market has been significantly affected by successive interest rate rises and cost-of-living pressures, leading to heightened interest in today's Budget announcement from the property industry to see what measures would be introduced to boost the sector.

In particular, the Chancellor announced a reduction in capital gains tax from 28% to 24%, aiming to increase revenues and property transactions. Furthermore, the government will no longer provide stamp duty relief for individuals purchasing more than one dwelling.

Moreover, the Chancellor stated plans to eliminate tax breaks that currently incentivize second-home owners to let their properties to holidaymakers rather than long-term tenants.

Hunt says he will abolish the furnished holiday lettings regime.

Additional highlights:

+ A further 2p cut to National Insurance – following the 2p reduction which was announced in the Autumn Statement.

+ Non-dom tax regime, for UK residents whose permanent home is overseas, to be replaced with new rules from April 2025

+ Full child benefits to be paid to households where highest-earning parent earns up to £60,000, limit is £50,000 currently

+ Partial child benefit to be paid where highest earner earns up to £80,000

+ The Household Support Fund, which allows local councils to help families via food banks, warm spaces and food vouchers, will be extended beyond 31 March. It will continue for six months, Hunt says.

+ Fuel duty will remain at its current rate and be frozen for the next 12 months; “temporary” 5p cut on fuel duty which was due to end this month will be extended.

+ The threshold for VAT registration will go up from £85,000 to £90,000.

+ New British ISA: An extra £5,000 tax-free allowance for the public to invest exclusively in UK.

+ Longer repayment period for people on benefits taking out emergency budgeting loans from the government

+ £90 fee to obtain a debt relief order scrapped

+ Government fund for people struggling with cost of living pressures to continue for another six months

Sourced from Property Industry Eye